Debt collection has always been a challenging field, requiring a delicate balance of persistence, compliance, and empathy. Traditional call centers and manual outreach methods, while effective to some extent, come with their own set of limitations—high operational costs, agent burnout, compliance risks, and inconsistent customer experiences. Enter AI voice agents, a revolutionary technology transforming automated debt recovery by enhancing efficiency, compliance, and debtor engagement.

What is an AI Voice Agent in Debt Collection?

An AI voice agent is an intelligent system AI-powered collections by advanced natural language processing (NLP) and machine learning algorithms. These agents are designed to engage debtors in real-time conversations, interpreting tone and context to provide appropriate responses. Unlike human agents, AI voice agents do not experience fatigue or stress, ensuring every interaction remains consistent and compliant with industry regulations.

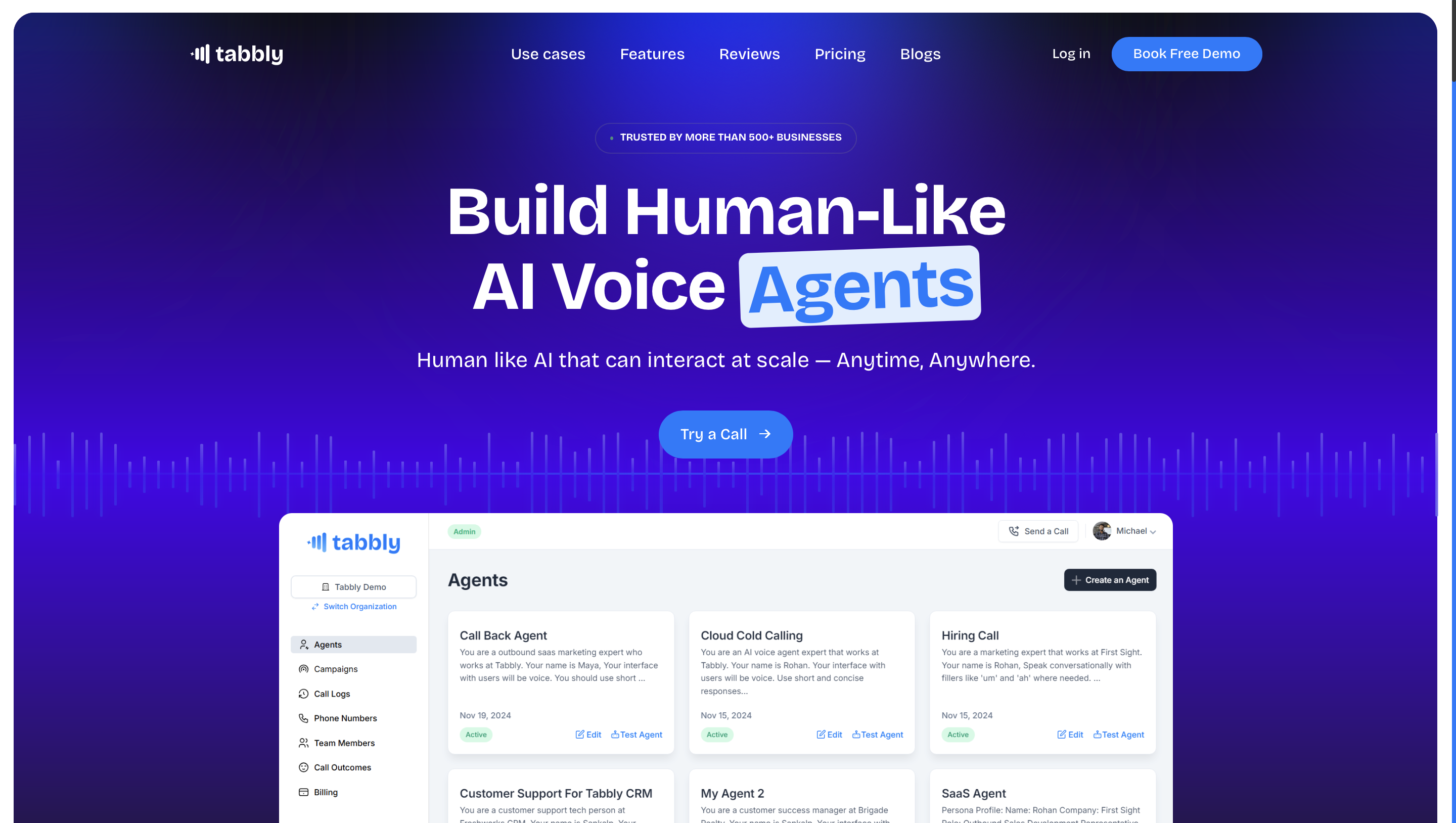

One of the leading AI voice agents in the debt collection industry is Compass, which employs state-of-the-art NLP technology to converse with debtors, detect frustration, and adapt its approach accordingly. Similarly, Tabbly AI voice agents are making waves by offering seamless, intelligent, and highly scalable solutions for debt collection agencies.

How AI Voice Agents Improve Debt Collection Efficiency

- Scalability: voice AI for debt can handle thousands of AI call agent simultaneously, something impossible for human agents. This level of scalability allows debt collection agencies to reach more debtors in less time, improving recovery rates without increasing operational costs.

- Compliance and Accuracy: Regulatory compliance is a major concern in debt collection. AI voice agents follow pre-set compliance scripts, ensuring no deviation from legal guidelines. They also debt recovery automation log interactions for audit purposes, reducing the risk of compliance violations.

- Cost Reduction: With AI handling repetitive collection tasks, agencies can significantly cut down on labor costs associated with hiring, training, and retaining human agents. The automation of initial outreach, follow-ups, and payment negotiations minimizes the need for large call center teams.

- Enhanced Debtor Engagement: Unlike debt recovery automation robocalls, AI voice agents can engage in two-way conversations, recognizing speech patterns and responding accordingly. Debtors are more likely to cooperate when they feel heard and understood, leading to improved recovery rates.

- Faster Debt Resolution: AI-driven systems can quickly analyze debtor profiles, past interactions, and payment histories to suggest personalized repayment plans. This proactive approach helps resolve debts faster and improves customer satisfaction.

- Seamless Integration with Existing Systems: AI voice agents can be easily integrated with customer relationship management (CRM) software, payment gateways, and communication platforms, ensuring a streamlined workflow for AI in collections.

- Automated Follow-Ups: Consistent follow-ups are key to debt recovery automation. voice AI for debt can schedule reminders, send notifications, and follow up with debtors at the right intervals, ensuring higher response rates.

- Improved Call Handling Efficiency: AI voice agents eliminate long hold times and unnecessary call transfers, allowing debtors to get quick and accurate responses without frustration.

- Customizable Debt Collection Strategies: AI voice agents can adjust their approach based on debtor behavior, ensuring personalized interactions that increase repayment likelihood.

- Predictive Analytics for Proactive Collection: By analyzing historical data, AI voice agents can predict which debtors are more likely to pay and prioritize AI call agent accordingly, improving overall efficiency.

The Role of AI in Improving Collection Outcomes

AI in collections are proving to be more effective than traditional collection methods, as evident from real-world statistics. Agencies utilizing AI-driven debt collection solutions report up to a 30% increase in recovery rates. The key drivers of this success include:

- Optimized Call Timing: AI analyzes debtor behavior and payment patterns to determine the best time to initiate calls, maximizing the chances of a positive response.

- Emotion Detection & Adaptive Conversations: AI voice agents can identify frustration, stress, or hesitation in a debtor’s tone and pivot their approach to de-escalate situations, making interactions more constructive.

- Data-Driven Insights: AI continuously learns from past interactions, refining its strategies to improve future collection efforts.

- Real-Time Performance Monitoring: AI dashboards provide real-time analytics on AI call agent success rates, debtor responses, and campaign effectiveness, helping agencies make data-driven decisions.

- Multi-Channel Engagement: AI voice agents can integrate with SMS, email, and chatbots to create a seamless omnichannel communication experience, ensuring higher debtor engagement.

How AI Voice Agents Enhance Customer Experience?

Debt collection often carries a stigma of aggressive tactics and harassment. However, AI voice agents are changing this perception by making interactions more professional, empathetic, and non-intrusive. Here’s how they improve customer experience:

- Consistent and Non-Judgmental Communication: Unlike human agents who may unconsciously show bias or frustration, AI voice agents maintain a neutral and polite tone, fostering a more comfortable conversation.

- 24/7 Availability: AI voice agents operate around the clock, allowing debtors to respond at their convenience without the pressure of business-hour limitations.

- Multilingual Capabilities: Many AI-driven debt collection solutions support multiple languages, making it easier to communicate with diverse debtor populations.

- Customizable Responses: AI voice agents can personalize communication strategies based on debtor profiles, ensuring a more tailored and effective approach.

- Decreased Call Abandonment Rates: Since AI voice agents eliminate long wait times, debtors are less likely to abandon calls, leading to more successful engagements.

- Transparency and Trust Building: AI systems can provide clear repayment options and automate dispute resolution, building trust between debtors and collection agencies.

The future of Debt Collection

The debt collection industry is undergoing a significant transformation, with AI voice agents becoming a cornerstone of modern recovery strategies. Companies like Compass and Tabbly are leading this shift by offering advanced AI-driven solutions that enhance efficiency, improve recovery rates, and ensure compliance.

As AI technology continues to evolve, we can expect even greater enhancements in voice agents, such as improved emotional intelligence, deeper personalization, and integration with omnichannel communication platforms. The future of debt collection is not just about automation—it’s about intelligent, ethical, and efficient engagement that benefits both creditors and debtors alike.

Are you ready to revolutionize your automated debt recovery strategy? AI voice agents like Compass and Tabbly are already reshaping the industry—don’t get left behind.

Tabbly: Revolutionizing Customer Engagement with AI Voice Agents

What is Tabbly?

Tabbly is an advanced AI voice agent company that specializes in automating customer interactions and streamlining communication processes. Designed to enhance efficiency, Tabbly’s AI-powered collections handles inbound and outbound calls with human-like precision, improving customer experience while reducing operational costs.

Learn more about: Can AI Voice Agents Truly Manage Complaints in Debt Collection?

How Tabbly’s AI Voice Agents Work?

Tabbly’s AI voice agents use natural language processing (NLP) and machine learning to engage in real-time conversations. These intelligent systems can understand customer queries, provide instant responses, and even escalate complex issues to human representatives when necessary.

Key Benefits of Tabbly’s AI Voice Agents

- 24/7 Availability – Handle customer queries anytime without delays.

- Cost-Effective Solution – Reduce the need for large customer support teams.

- Scalable and Efficient – Manage high call volumes effortlessly.

- Personalized Interactions – Deliver human-like conversations with AI-driven intelligence.

- Seamless Integrations – Connect with CRM, helpdesk, and business tools for smooth operations.

Why Businesses Choose Tabbly?

Companies across industries, from finance to e-commerce, trust Tabbly to enhance customer engagement and optimize their communication strategies. With AI voice agents capable of handling debt collection, customer support, and sales calls, Tabbly is reshaping the future of voice-based automation.

Final Thoughts

Tabbly’s AI voice agents provide a smarter, faster, and more efficient way for businesses to interact with customers. By leveraging AI-driven automation, companies can boost customer satisfaction, reduce costs, and scale their operations seamlessly.

Frequently Asked Questions (FAQs) About AI Voice Agents in Debt Collection

1. What is an AI voice agent for debt collection?

An AI voice agent for debt collection is an automated system powered by artificial intelligence that handles debt recovery calls. It interacts with customers in a human-like manner, reminding them of due payments, negotiating settlements, and answering queries efficiently.

2. How does an AI voice agent improve the debt collection process?

AI voice agents enhance the debt collection process by automating repetitive calls, ensuring 24/7 availability, reducing operational costs, and improving customer engagement through personalized and professional interactions.

3. Can AI voice agents handle complex debt recovery scenarios?

Yes, AI voice agents can manage complex debt recovery cases by using natural language processing (NLP) to understand customer responses and escalate difficult situations to human agents when needed.

4. Are AI-powered collections more effective than traditional methods?

AI-powered collections are often more effective than traditional methods because they offer faster response times, consistent messaging, and scalable operations while reducing human error and increasing recovery rates.

5. How does voice AI for debt collection enhance customer experience?

Voice AI improves customer experience by offering polite, non-intrusive, and professional interactions, providing flexible payment options, and ensuring a smoother resolution process without aggressive collection tactics.

6. Can AI call agents integrate with existing debt collection software?

Yes, AI call agents can seamlessly integrate with CRM systems, payment gateways, and debt collection platforms to streamline operations and provide real-time updates on customer interactions.

7. Is AI-based debt recovery automation secure and compliant?

Most AI-based debt recovery solutions comply with industry regulations like TCPA and FDCPA, ensuring secure, ethical, and legally compliant interactions while protecting customer data.

8. What industries can benefit from AI voice agents in debt collection?

Industries such as banking, healthcare, telecommunications, utilities, and fintech can leverage AI voice agents to automate debt recovery, improve cash flow, and enhance customer relationships.

9. How scalable are AI-powered debt collection solutions?

AI-powered debt collection solutions are highly scalable, allowing businesses to handle thousands of calls simultaneously without increasing operational costs or requiring additional human agents.

10. What is the future of AI in debt collection?

The future of AI in debt collection includes advancements in voice recognition, predictive analytics, and machine learning, making collections more efficient, personalized, and customer-friendly while improving recovery rates.