Debt recovery is a challenging process. High call volumes, emotionally charged conversations, and strict legal regulations make it difficult for agencies to maintain efficiency while ensuring compliance. Traditional debt collection methods often involve human agents making repeated calls, dealing with resistance, and navigating complex negotiations. However, Voice AI for debt recovery is changing the game by automating the process, improving engagement, and increasing recovery rates—all without exhausting human resources.

How Voice AI is Transforming Debt Recovery

Voice AI is an advanced technology that mimics human conversation while leveraging data-driven insights to enhance collection efforts. Unlike traditional automated calls, AI-driven voice agents can engage in dynamic, two-way interactions with debtors, understanding their responses, adjusting tone and language, and offering solutions in real-time.

For example, a tool like Compass can:

- Identify the best time to contact debtors based on behavioral data and payment history.

- Personalize outreach strategies to match debtor profiles, increasing engagement.

- Negotiate payment plans dynamically based on financial history and repayment capacity.

- Adapt in real-time by switching languages or modifying tone for a more empathetic approach.

- Follow up at optimal intervals to maintain communication and reduce defaults.

Why Voice AI is More Effective Than Traditional Methods?

1. Increased Efficiency and Cost Savings

- Scalability: Unlike human agents who can handle one call at a time, AI voice agents can process thousands of calls simultaneously.

- Reduced operational costs: Fewer human agents are required, lowering labor expenses and training costs.

- Faster recovery cycles: AI-driven interactions help debtors understand their obligations quickly, leading to up to 25% faster resolutions.

- Minimized manual workload: Automating routine debt collection calls allows human agents to focus on complex negotiations or high-value cases.

- Consistent follow-ups: AI ensures regular follow-ups without any lapses, increasing the likelihood of timely payments.

2. Improved Compliance and Reduced Legal Risks

- Adherence to regulations: AI ensures 100% compliance with debt collection laws like the Fair Debt Collection Practices Act (FDCPA) and Telephone Consumer Protection Act (TCPA).

- Eliminates human error: Unlike human agents who may unknowingly breach compliance, AI follows pre-approved scripts and rules.

- Proper documentation: Every AI-led interaction is logged and recorded, making audits and compliance checks easier.

- Non-aggressive communication: AI agents use neutral, respectful, and legally compliant language, reducing the risk of consumer complaints or lawsuits.

- Controlled call frequency: AI ensures calls are not excessive, avoiding harassment claims while maximizing collection efficiency.

3. Enhanced Debtor Experience

- Non-judgmental approach: Unlike human agents who may sound frustrated, AI agents remain patient and professional at all times.

- Empathetic communication: AI detects emotional cues in a debtor’s voice and adjusts tone accordingly.

- Custom repayment solutions: Based on debtor profiles, AI suggests flexible payment plans tailored to individual financial situations.

- 24/7 availability: Debtors can engage with AI agents at their convenience, improving response rates.

- Avoids call fatigue: AI ensures communication remains non-intrusive, helping debtors stay engaged instead of feeling overwhelmed.

4. Personalized Communication and Higher Engagement

- Debtor-specific call scripts: AI customizes scripts based on payment history, financial behavior, and past interactions.

- Language adaptability: AI agents can communicate in multiple languages, making debt collection more accessible to diverse audiences.

- Real-time sentiment analysis: AI detects debtor tone and adjusts responses accordingly, improving engagement.

- Flexible negotiation options: AI can offer discounts, partial payments, or installment plans based on the debtor's ability to pay.

- Follow-up optimization: AI predicts the right time to follow up, increasing the chances of a positive response.

5. 24/7 Availability and Consistency

- Round-the-clock debt collection: AI agents operate 24/7, ensuring no missed opportunities for outreach.

- Consistent messaging: Every call follows a structured, professional, and compliant approach.

- Eliminates agent fatigue: Unlike human agents who may have bad days or inconsistencies, AI maintains the same high-quality interactions at all times.

- Self-service options: AI can direct debtors to online portals where they can schedule payments or make real-time transactions.

- Improved debtor convenience: Calls can be scheduled at debtor-friendly hours, reducing call drop-off rates.

The Future of Debt Recovery with Voice AI

Voice AI is not just an alternative to traditional debt collection methods—it is the future of the industry. As AI continues to evolve, future advancements will include:

- Sentiment-driven negotiation: AI will better understand debtor emotions and modify negotiation strategies accordingly.

- Predictive analytics: AI will analyze debtor payment behavior and predict the likelihood of payment before even making a call.

- Multi-channel AI integration: AI-driven voice agents will work alongside chatbots, SMS, and email automation for a seamless debt collection experience.

- Voice biometrics for security: AI will use voice recognition to verify debtor identities, reducing fraud and increasing security.

- AI-powered legal compliance checks: Future AI models will continuously update compliance protocols to match evolving debt collection laws.

Agencies that adopt voice AI for debt recovery now will gain a competitive edge, reducing costs while increasing collections. The combination of automation, compliance, and personalization makes voice AI a powerful tool for modernizing debt recovery processes.

Best Script Templates for AI-Powered Debt Recovery Calls

AI-powered voice agents rely on well-structured scripts to engage debtors effectively. The right script ensures compliance, maintains professionalism, and increases the chances of successful debt recovery. Below are three script templates tailored for different scenarios.

1. Payment Reminder Script (Before Due Date)

Objective: Gently remind the debtor about an upcoming payment to encourage timely settlement.

AI Voice Agent:

"Hello [Debtor’s Name], this is an automated call from [Company Name]. We’re reaching out to remind you that your payment of [Amount] is due on [Due Date]. If you’ve already made this payment, kindly disregard this message. Otherwise, you can make your payment now by visiting [Payment Link] or calling [Customer Service Number]. If you need assistance, press 1 to speak with a representative. Thank you and have a great day!"

2. Overdue Payment Script (After Due Date)

Objective: Notify the debtor about a missed payment and offer assistance to resolve the issue.

AI Voice Agent:

"Hello [Debtor’s Name], we noticed that your payment of [Amount] due on [Due Date] has not been received. We understand that unexpected situations can arise, and we’re here to help. You can make a payment today by visiting [Payment Link] or calling [Customer Service Number]. If you need to set up a payment plan, press 2 for options. Please take action soon to avoid additional fees. Thank you!"

3. Final Notice Script (Escalation Warning)

Objective: Urge the debtor to act before further legal or financial consequences occur.

AI Voice Agent:

"Hello [Debtor’s Name], this is an urgent notice regarding your overdue balance of [Amount]. Despite multiple reminders, we have not received a payment. To avoid escalation, we strongly encourage you to settle your account today. You can pay online at [Payment Link] or call [Customer Service Number] for assistance. If payment is not received by [Final Due Date], further action may be taken. Please take immediate steps to resolve this matter. Press 3 if you need support. Thank you."

These AI-driven scripts ensure clear, professional, and legally compliant communication, increasing the chances of recovering outstanding debts while maintaining a positive debtor experience.

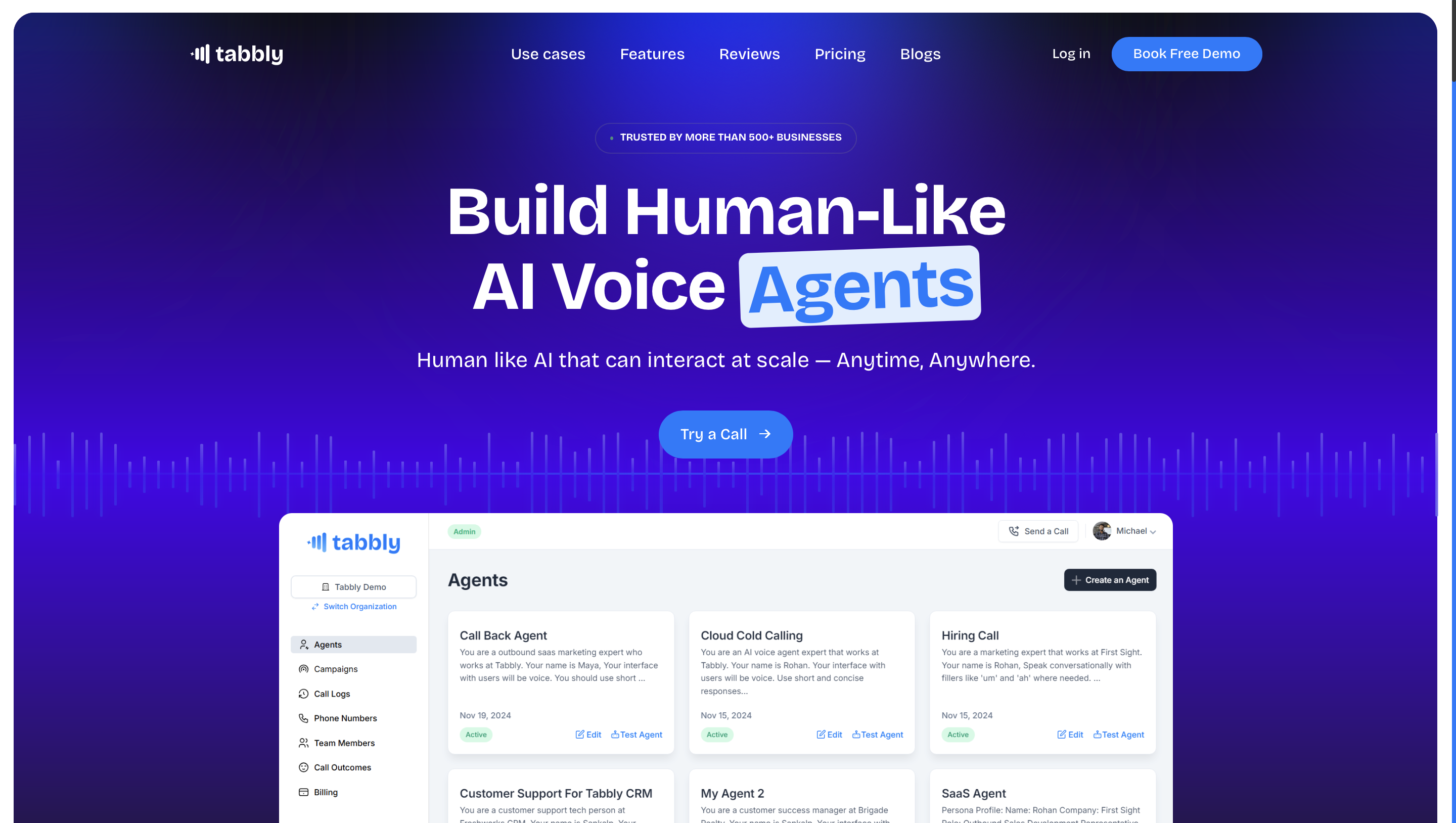

How Tabbly.io Transforms debt collection automation with AI Voice Agents?

1. Scalability and Efficiency

Tabbly's AI voice agents can handle thousands of debt collection calls daily, significantly increasing outreach and improving recovery rates. Unlike manual calls, which limit the number of debtors that can be contacted, Tabbly ensures a high volume of engagement, boosting collection efficiency.

2. 24/7 Availability

Unlike human agents restricted to working hours, Tabbly's AI voice agents operate round the clock. This continuous availability ensures that debtors can be contacted at convenient times, increasing the likelihood of successful payments.

3. Compliance and Consistency

Debt collection involves strict legal guidelines, and Tabbly ensures compliance by following standardized communication protocols. The AI voice agent eliminates human errors and maintains a respectful, legally compliant tone, reducing the risk of violations.

4. Cost Reduction

By automating debt collection calls, Tabbly helps lenders reduce the need for large call center teams, cutting operational costs while maintaining efficiency. Human agents can then focus on high-value tasks, improving overall debt recovery strategy.

5. Enhanced Customer Experience

Tabbly's AI-powered voice agents provide human-like, non-intrusive interactions that make debtors feel comfortable. This improves the debtor experience, leading to better cooperation and increased payment success rates.

By leveraging Tabbly’s AI voice agents, businesses can streamline their debt recovery process, improve efficiency, and ensure compliance, making it a game-changer in the future of collections.

Final Thoughts On AI call agents

In an industry where every dollar recovered matters, Voice AI for debt recovery provides a smarter, more effective solution. It helps agencies streamline operations, enhance debtor communication, and ensure compliance—while also improving collection rates.

With AI-powered tools like Tabbly, debt recovery no longer has to be a stressful, manual process. Instead, it becomes a strategic, data-driven, and highly efficient operation.

Look more on:The Future of Debt collection with AI Voice Agents

Are you ready to revolutionize your debt collection strategy? Voice AI might just be the breakthrough your agency needs.

FAQ'S on Voice AI for Debt Recovery

What is Voice AI for debt recovery?

Voice AI for debt recovery is an artificial intelligence-powered system that automates collection calls, personalizes debtor interactions, and improves recovery rates while ensuring compliance with legal regulations.

How does AI-powered debt collection work?

AI-powered debt collection uses automated voice agents to engage with debtors, send payment reminders, negotiate settlements, and follow up—reducing the need for human intervention and increasing efficiency.

What are the benefits of automated debt recovery?

Automated debt recovery improves efficiency, reduces operational costs, ensures compliance, enhances debtor experience, and increases the likelihood of timely payments through personalized and consistent communication.

How do AI call agents improve debt collection?

AI call agents handle high call volumes, engage debtors with natural language processing, provide customized payment options, and operate 24/7—leading to better recovery rates and improved customer interactions.

What makes debt collection automation more effective than manual calls?

Debt collection automation eliminates human error, increases outreach, ensures compliance, personalizes interactions, and allows businesses to handle thousands of accounts simultaneously without increasing staff.

How does smart debt recovery enhance collection efforts?

Smart debt recovery leverages AI-driven insights to determine the best time to call, tailor scripts based on debtor behavior, and optimize communication strategies for better results.

What role does Voice AI play in collections?

Voice AI in collections streamlines communication by using intelligent speech recognition and response mechanisms to engage with debtors, address concerns, and encourage timely payments.

Why should businesses invest in AI for debt recovery?

Businesses should invest in AI for debt recovery to increase efficiency, reduce costs, improve debtor engagement, ensure compliance, and enhance the overall effectiveness of their collection process.